Inflation dismantles plans for investment

Inflation has caused businesses in West and North Yorkshire to effectively dismantle plans for investment, new research from West & North Yorkshire reveals.

The Chamber’s Quarterly Economic Survey for the final three months of 2022 showed that significant challenges on costs, recruitment and the value of Sterling persisted to a significantly high degree among both service and manufacturing firms.

However, following the low point that followed the disastrous mini-Budget under former Prime Minister Liz Truss and the collapse in the markets that ensued thereafter, there is cautious optimism among bosses that turnover and profit will begin to improve in the early months of 2023.

The service sector bounced back to a more respectable level during the fourth quarter of 2022 and manufacturers saw an improved picture for their overseas sales. The proof will very much be in the pudding in the figures for the next quarter when we will learn if this is part of an overall upward trend or merely a bounce from a notable low point.

However, the headwinds remain strong. Cashflow for manufacturers in West and North Yorkshire is notably poorer than the rest of the country and employment and investment prospects remain weak in West and North Yorkshire as firms facing a situation in which they are concentrating on the here and now.

With both the British Chamber of Commerce (BCC) and the Bank of England predicting a protracted recession it is clear we are in for a tough 2023. BCC expects to see us return to economic growth by this point next year and for inflation to peak at 11 per cent before falling to five per cent by the end of 2023.

But our region has been here before. We are blessed to be home to a world class business community and our economic leaders know how to navigate tough times.

As a Chamber, we remain ready to provide support and a bold series of initiatives and events are planned for the months ahead to make sure that we can seize every opportunity for growth.

Amanda Beresford, chair of West & North Yorkshire Chamber of Commerce, said: “There is no getting away from the fact that 2022 finished on a challenging note for our region’s economy. After a year of grappling with increasing prices and difficulties on the supply side of doing business, firms in our region have had no option other than to get comfortable with being uncomfortable.

“While the impacts of the numerous difficulties our economy faces are still being felt keenly, we should take heed of the fact that there are numerous signs that business leaders here in Yorkshire are beginning to see indications of optimism on the horizon.

“Question marks remain over what happens when the energy price cap comes to an end in March and, as a Chamber, we will continue to press ministers on ensuring energy costs do not become unsustainable.”

Mark Roberts, Leeds City Region Enterprise Partnership Chair, said: “The final Quarterly Economic Survey of 2022 does present some positive ‘green shoots’ across the business base in West and North Yorkshire.

“However, there are still some key challenges that businesses are facing that are likely to linger into next year. Inflation is a key cost pressure across the entire business base, cited by 80 per cent of manufacturing firms and 79 per cent of service sector businesses.

“Whilst the two issues are linked, firms are significantly more concerned about inflation than interest rates, likely due to the more immediate impact which inflation is having on input prices.”

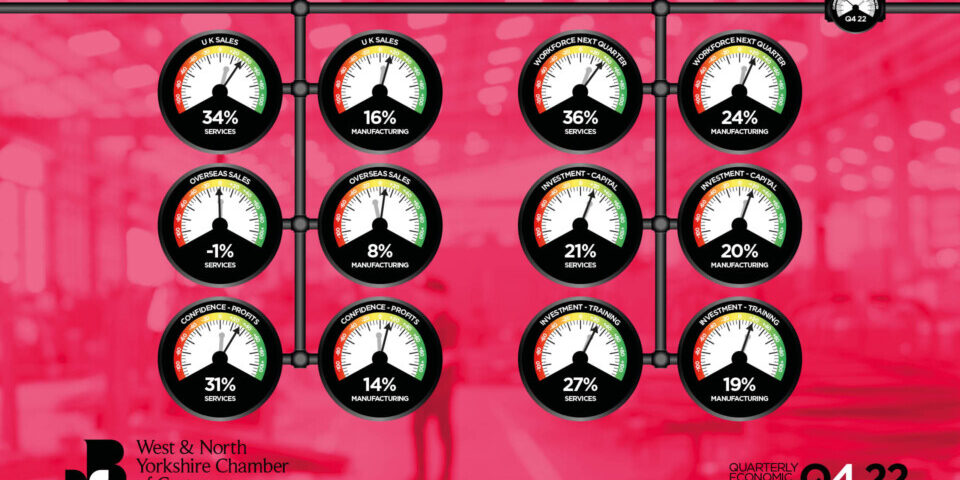

DOMESTIC SALES

After falling to a three-year low point, UK sales began to move in the right direction, albeit at a faster pace for the service sector versus manufacturing. The state of firms’ order books is also improved hinting at improved demand, although still not quite at that seen in the summer.

Sales were up by 19 per cent in the service sector and eight per cent in manufacturing.

EXPORT SALES

There was better news for manufacturers this quarter with international sales now back to levels seen before the summer. However, the service sector is now back to the levels seen at the start of 2021.

Service sector sales were down by two per cent while manufacturers saw sales increase by 20 per cent.

INVESTMENT

Given the scale of the challenges seen both domestically and internationally, it was inevitable that many plans for investment are being put on hold, although there were small improvements in the number of manufacturers looking to invest in new equipment.

Service sector firms saw investment drop by two per cent while manufacturers increased investment by four per cent.

EMPLOYMENT

The labour market remains extremely tight. The service sector saw little movement from the last quarter in terms of new hires while manufacturing slipped slightly during the same period. There is some optimism to be found in the fact that employers anticipate a small increase in employment in the next 12 weeks.

Service sector firms increased employment intent by 15 per cent with manufacturers posting a 13 per cent increase.

BUSINESS CONFIDENCE

Outlook has improved from the low ebb seen during Q3 with bosses expecting to see turnover and profits improve at a much higher level than seen previously. After a dark period of rising costs and staff shortages, there is a sense among some that better days lie ahead.

Service sector firms increased profitability confidence by 27 per cent while manufacturers registered a 17 per cent increase.

NATIONAL AND REGIONAL COMPARISONS

We are looking at a veritable mixed bag when it comes to our comparison to the rest of the nation. It is heartening to see both manufacturing and service firms showing greater appetites for both capital and training investments than elsewhere in the country. Similarly domestic sales for services look strong when compared with both the North of England and the rest of the UK.

Cashflow for manufacturing across West and North Yorkshire however remains a worry given how far we lag behind other geographies, hinting that inflation is taking a more serious toll on this sector than elsewhere in the UK.