British Chambers welcomes further interest rate hold

Reacting to the latest Bank of England interest rate decision, David Bharier, Head of Research at the British Chambers of Commerce, said:

“Today’s decision to again hold the interest rate at 5.25% will allay some concerns of the businesses we speak to that are unable to stomach further rises.

“Our research has shown that interest rates have grown as a key issue among companies. This is especially true for smaller firms and those in the consumer-facing sectors, who have seen rising borrowing costs and decreased customer demand.

“The BCC’s Quarterly Economic Survey for Q3 found that 45% of all firms cited interest rates as a concern. With inflation set to ease further, and GDP and labour market data indicating the economy is cooling, the Chancellor’s Autumn Statement must set out a plan for growth.

“SMEs have been operating in an uncertain climate for too long, with policies constantly chopping and changing over the past few years. They need to see clear direction from decision makers, creating a roadmap for business that really boosts confidence and investment.”

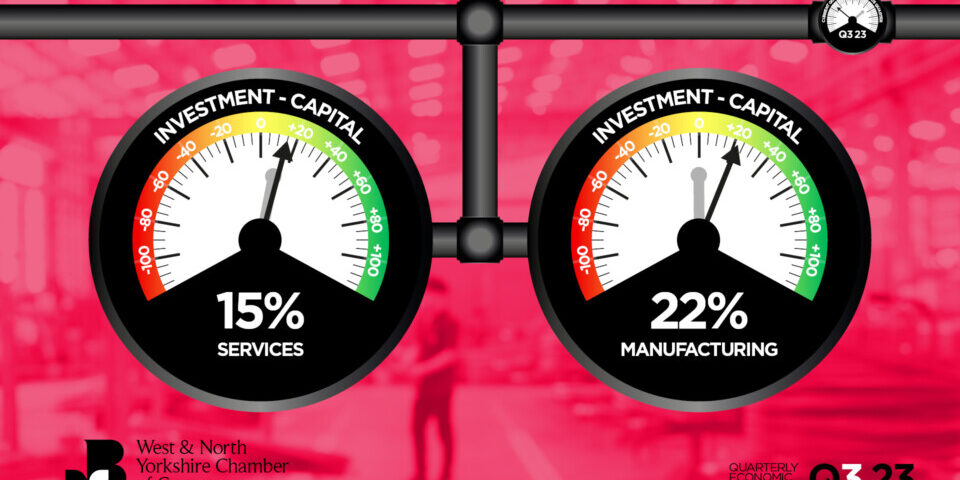

For a regional view of the national economy you can read the West & North Yorkshire Chamber QES Report online